While it seems like a fundamental business analytic, Customer Lifetime Value (CLV) is actually a more powerful tool when you can act on what it’s telling you. CLV is the average revenue you’ll receive from a customer over the lifetime of their relationship with your brand.

Using the customer lifetime value formula, you can look deeper into your business’s current and future state to learn more about:

- Average number of customers at one time

- Average purchase value

- Customer acquisition cost

- Retention rate

In this article, we’re going to dive deeper into the customer lifetime value formula and share:

- How to calculate CLV

- How to analyze and use CLV

- What is a good CLV

- How to improve your average CLV

- How to get deeper CLV insights

Contents

How to calculate customer lifetime value

The basic formula to calculate customer lifetime value (CLV) is as follows:

Average Transaction ($) X # of Transactions X Retention Timeframe = Customer Lifetime Value (CLV)

How Starbucks calculates lifetime customer value

In a case study by Kissmetrics, Starbucks uses a combination of three custom CLV formulas to develop their average lifetime customer value of $14,099.

Starbucks added additional variables to use in their calculations:

- s = average spend per purchase ($5.90)

- c = average visits per week (4.2)

- a = average value per week ($24.30)

- t = average customer lifespan (20 years)

- r = customer retention rate (75%)

- p = profit margin (21.3%)

- I = rate of discount, to determine the present value of future cash flow (10%)

- M = average gross profit margin per customer, over the lifespan ($5382.94)

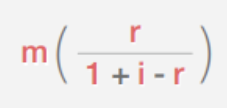

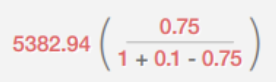

They take the above values and use them in three formulas to get three different CLVs. Then they average the three CLVs to come up with their final customer lifetime valuation:

| Simple CLV formula | Custom CLV formula | Traditional CLV formula | |

| Formula | 52(a) x t | t(52 x s x c x p) |  |

| Values | 52(24.30) x 20 | 20(52 x 5.90 x 4.2 x 0.213) |  |

| Calculated CLV | $25,272 | $5,489 | $11,535 |

| Average CLV | $14,099 | ||

The simple CLV formula used by Starbucks is similar to the first equation we presented above, only instead of calculating based on spend per purchase, it’s calculated based on spend per week.

How do you calculate the lifetime value of a SaaS customer?

Once you know the customer lifetime value formula, you can use it to calculate the CLV for your Software as a Service (SaaS) business.

For example, if you sell a subscription for $20 a month, and the average subscriber stays for 18 months (1.5 years), your CLV would be calculated as:

$20 (subscription cost) x 12 (transactions per year) x 1.5 years = $360 CLV

How do you calculate the lifetime value of a customer in Excel?

If you don’t have an analytics app or machine learning database for calculating customer lifetime value, you can use an excel spreadsheet. To do this, you need the following data:

- Average purchase value (total revenue divided by total orders)

- Purchase frequency (total orders divided by total customers)

- Churn rate (customers lost during the period divided by customer total at the start of the period)

- Estimated customer lifetime (1 divided by churn rate percentage)

First, export all your sales and revenue data into columns or tabs in a spreadsheet. Use the AVERAGE or SUM calculation functions to get the values you need for your formula calculations.

On a new spreadsheet tab, choose your CLV formula and link each cell to the average or sum values in the other sheets.

How do you analyze and use customer lifetime value?

Knowing your CLV helps you better understand your typical existing customer and better understand how to attract new customers. When you use detailed customer insights, you can find ways to make both current and new clients happier, so they spend more and stay loyal to your brand longer. You’ll likely see an increased customer retention rate and a higher average cost per sale when your customers are satisfied.

When you measure customer lifetime values, you get the basis to understand your business better and help inform critical business and budgeting decisions. These include:

Advertising

Advertising isn’t always cheap, but knowing your customer acquisition costs can help you determine how much you should invest in your advertising. For example, if you measure your customer lifetime and know they stay loyal for two years and have an average of $250,000 CLV, you’ll feel confident spending $200 per qualified lead in ad spend.

On the other side, if you know your lifetime customer value is $250, it’s not good business sense to have a marketing budget per lead over that amount because you’re losing money.

Marketing

Your CLV may show that people only stay loyal customers for a short period. Knowing this, your marketing team can create campaigns for areas of the customer journey that are experiencing inefficiencies or when clients are dropping off. This new content is aimed at extending customer loyalty over a longer term.

Sales

To help inform your customer acquisition strategy, your sales team needs to know how hard to work to make a sale. It doesn’t make sense for your top sales team members to spend 20 billable hours to close a client if their customer lifetime value is only a few hundred dollars.

Customer Support

Lousy customer service can break a company, even one that sells a perfect product that never fails. When your customer support team has insights into your existing customers’ lifetime value, they can develop goals within their team to provide even better customer service to help increase customer lifetime.

Business Operations

Knowing your CLV helps you and your product teams with revenue forecasting and budgets. When you know you have an average of 1000 active monthly subscribers, and they stay with you for an average of 24 months, you can calculate 2 years of reasonably expected revenue from this stream.

What is a good CLV?

A “good” CLV is subjective, but at its core, it should be a higher dollar value than your customer acquisition costs. Profitable businesses shouldn’t spend more money acquiring a new customer or client than they’re expecting in revenue from that client over the customer’s lifetime.

There may be some business cases, however, where it’s acceptable to have a customer lifetime value lower than your acquisition costs. For example, if you are explicitly targeting influencers or referral partners, you may be ok with accepting a “loss” because they’re likely to bring in more of your ideal customers with a higher average customer lifespan and value.

Knowing your CLV metrics can help you plan revenue flow and inform business decisions. Once you know your CLV, it’s time to see where you can optimize your business operations and processes to improve this value.

Customer lifetime value formula examples

Using the customer lifetime value formula and machine learning artificial intelligence, organizations worldwide are boosting client retention and satisfaction to ultimately raise their CLV. Here are a few examples of companies who are using the data from calculating customer lifetime to become more successful:

FabFitFun

FabFitFun is a monthly subscription box where subscribers get full-sized product samples every month. They struggled with customer churn (aka average customer lifespan), so they looked to machine learning to uncover where they could optimize their business to increase their average customer lifetime.

Idiomatic analyzed data from customer surveys and support contacts in real-time to see what was triggering high customer churn rates. After implementing changes based on these findings, they saw a 49% decrease in complaints and a 250% increase in product satisfaction by addressing these concerns. This ultimately increased their CLV.

Instacart

Instacart offers grocery delivery and pick-up services through peer-sourced personal shoppers. Routing support tickets based on customers’ self-selection lacked the precision needed to specialize agents. The support experience was not great, leading to lower than expected repeat business.

Idiomatic’s machine learning tool integrated with their Zendesk ticketing system to better analyze customer service complaints. They could better streamline support workflows and use real-time insights to make changes to eliminate customer pain points. With these new systems in place, Instacart increased their positive Customer Satisfaction Scores (CSAT) by 35% to earn the repeat business they needed to boost their customer lifetime values.

How to improve your average customer CLV

The goal of making money and growing your business is to get a higher CLV from your customers or clients. This means you need higher sales, increased frequency, and longer brand loyalty. Here are a few ways you can do that:

Encourage brand loyalty

Reward programs and incentives for repeat buyers or long-term customers are excellent ways to encourage loyalty. Have a “punch card” program where they get a free item with every 10 purchases. Consider bonus offers for repeat purchases or customer purchase anniversaries.

Review your customer experience

Happy customers are loyal customers. All businesses should be measuring customer satisfaction through analyzing feedback forms, customer service requests, and talking with actual customers. Look for business processes, systems, or experiences that aren’t fully optimized to your customer’s satisfaction.

High-quality customer service can help customers overlook the occasional error or “break.” A great way to get feedback is through surveys. Here are 130+ effective survey questions you can use to gain valuable customer insights to boost your CLV.

Optimize customer onboarding

Don’t just sell your product or service and walk away. Look at your new customer onboarding process to ensure you give them everything they need to start using your product with success.

Boost customer engagement

Look for new ways to boost customer engagement through all your channels. This may mean interacting with them more on social media, through your customer support, or sales teams. You can send out feedback surveys, use analytics, try gamification, and check in with quiet customers.

Delight your customers

Happy customers usually make your most loyal followers and customers. Look for new ways to delight your customers, including changing how app or account notifications work, providing customized error messages, providing trials or test drives before they buy, offering free gifts with purchase, and adding personalized touches.

Implement robust analytics systems

You need the analytics to back up your claims to know if you’re improving. Combine that with machine learning algorithms and you’ll have all the details to see where you are now and compare your improvement in customer lifetime value as you make changes.

Make returns easy

Not everyone will be happy with your product or service. Don’t complicate the returns or refund process because you never know why your customer is returning the item. Perhaps they no longer need it or can’t afford it. Make your return or refund process easy, and they’re more likely to come back or refer you to a friend later.

Create content to nurture

Occasionally, your customer retention rate will drop when the customer is confused or feels there has been a miscommunication. Create content (like blogs, e-books, tutorial videos, and social content) to educate others about your company, your products, or your services. Make content for all stages of your marketing funnel, from prospects who have never heard of you or your solution to loyal customers looking to get even better results or outcomes from your product.

How to get deeper CLV insights

You can get helpful insights by calculating customer lifetime value (CLV) and comparing results over different periods; however, a deeper analysis can help you learn how to improve your results. Knowing where you can increase efficiencies, pricing, and customer satisfaction can help you boost your CLV scores by selling more, increasing average purchase value, and increasing the average customer lifetime value.

By using machine learning to analyze your customers’ feedback and understand what they are specifically saying, you can:

- Better understand your customer relationships

- Increase customer loyalty (as measured by NPS scores or other metrics)

- Improve customer retention rates

- Boost average purchase frequency

- Acquire customers more likely to be loyal

Are you ready to gain a competitive advantage? Request a demo of the Idiomatic’s AI-driven customer intelligence platform. You’ll get valuable insights into your customers that you can use to increase your customer lifetime value and better manage your marketing and sales spend, so your average acquisition cost isn’t more than your marketing expenses.