When it comes to getting insight into your customers and target audiences, there’s no better source of information than straight from the ‘horse’s’ mouth. Surveys provide an excellent opportunity for customers to share invaluable feedback. But in order to be meaningful, you need to have a sufficient sample size of respondents.

Getting sufficient survey responses can be difficult, especially if you’re asking your audience to provide feedback for the first time.

There are lots of factors to consider when trying to increase your survey response rate. For one, you need to consider the survey itself. Is it easy to participate in? Are the questions clear? Do they flow logically from one point to another? Is it too long for people to finish in one sitting?

You also need to make it appealing for your audience to respond to. Why should they help you out? Do you have a prior track record of communication? Do they understand how their feedback will be used?

There are a lot of moving pieces, but here are a few straight-forward strategies you can use to increase your survey response rate.

Contents

1. Keep it timely

As is the case with so many things, from comedy to romance, timing is everything. It’s important to ask for feedback before the right moment passes.

Sending a follow-up survey right after you’ve had an interaction with your customer is a great way to increase customer satisfaction survey response rates and ensure that the answers are still top of mind and accurate.

Even 24 hours is long enough for people to forget the details of their lengthy chat with your customer support team and be out of the right mind-frame to provide helpful feedback. Encourage customers to provide feedback in real-time, so you can make real-time adjustments.

2. Choose the correct channel

A big part of providing an excellent customer experience is meeting people where they are. Think about where your customers are and how they prefer to be communicated with. If you’re texting people who prefer email, they’re less likely to respond. You should also do your best to make it as easy as possible for them to respond in that channel. Better yet, you can make your surveys available on multiple channels to boost participation and get more feedback.

If email is your channel of choice, then it would be worth it to explore embedding the questions in the body of the email to make responding easy. Similarly, if SMS is your customer’s preferred communication method, make it so they can reply by text rather than sending them links to web-surveys that don’t even present well on mobile devices.

3. Give it a personal touch

Personalizing surveys can help increase survey response rates. Customizing the survey with information you already know can make it feel a little more human, and can make it feel like you really do care about their personal feedback. Using the would-be respondent’s name, referencing your exact interaction, and saying please and thank-you can go a long way.

4. Reminders get more survey responses

Sometimes people get busy. If you’ve missed the moment and people aren’t responding as quickly as you’d hoped, you can send one or two gentle reminders. Try rephrasing the request to keep it feeling fresh and personal, as opposed to standardized and spammy.

In addition to reminding respondents to start or finish your survey, providing feedback after the fact about the results of the survey, or how you’re going to act on their feedback, can help demonstrate that their contribution mattered, and make them more likely to respond in the future.

5. Offer incentives for survey respondents

A survey incentive is something you offer respondents who complete a survey. They can either be monetary (cash, gift certificate vouchers, coupons) or non-monetary (free pen, brochure, charity donations) in nature, and they’re one powerful way to thank respondents for taking the time to answer your questions.

Do incentives increase survey response rates?

Yes. Incentives have been proven to increase survey participation. But whether or not that’s always a good thing is up for debate.

Sometimes, offering incentives can attract the wrong respondents. If it’s publicly available, they might not even be your target audience. You may also end up with throwaway responses where people have rushed through, answering without thought, just to claim the prize.

Incentives can either be promised, where people have to respond in order to get the reward, or pre-paid, where everyone you’d like to respond gets a reward. Promised incentives are slightly easier to execute and tie the prize to the actual completion of the survey.

You can offer Oprah-style incentives (everyone gets a gift card!), or offer them to the first hundred respondents, or enter respondents into a sweepstakes.

6. Use an incentive sweepstakes

One form of incentive is to enter respondents into a raffle or sweepstakes for a large prize.

If you do want to run an incentive sweepstakes for survey responses:

- Make sure it’s legal. Sweepstakes must meet legal requirements which can vary by state and country.

- Address confidentiality issues up-front. With promised incentives, you often need to collect personal information to be able to follow through on the promise. It’s a good idea to reassure people that their personal information won’t be linked to their answers.

Before you go down this road, it’s good to keep in mind that while individually promised incentives for web surveys have been shown to increase survey response rates, the jury is still out on the impact of sweepstakes. There just hasn’t been enough research on this particular offer.

7. Optimize your survey

The longer your survey is, the greater the likelihood that people will quit part way through and reduce your overall survey response rate. Keep your survey short and focused, particularly if there’s no incentive for the respondents to finish the job.

We’ve put together a list of 130+ survey question examples for you to help craft the perfect survey, but a great starting point is to consider what you really need to know. If you’re not going to take action on the response, maybe don’t bother asking.

Similarly, good feedback doesn’t always fit on a scale from one to ten. Asking open ended questions on your survey is incredibly important and is often the true source of meaningful insights. Categorizing and internalizing long-form responses don’t need to be labor-intensive if you leverage a tool like Idiomatic’s machine learning to help you make the data matter. Idiomatic uses artificial intelligence to provide immediate feedback and action items.

It’s also just as important to double check that your survey works wherever your audience decides to take it; whether that’s on a desktop computer or a smartphone. Using a responsive survey software solution can reduce the number of people who abandon because it’s just not user-friendly enough.

8. Survey panel

Research panels are a group of pre-selected respondents who have agreed to participate in surveys. Using research panels can be an effective way to save time because you’re not needing to seek out new respondents every time you run a survey.

If you plan on conducting many surveys, especially for market research purposes, survey panels can be a great investment.

Understanding survey basics

Having a good response rate for your survey is imperative to having good quality data. Smaller response rates mean smaller samples, and when a sample size is small, it’s more likely that you won’t get an accurate portrait of the group you’re trying to understand.

Here are the answers to some frequently asked survey questions:

What is a good response rate for a survey?

Generally speaking, irrespective of survey type, the average survey response rate can range between 5% and 30%. According to 2018 research, survey response rate of 50% or higher is often considered excellent and 33% is pretty good. However these numbers vary slightly depending on your particular audience demographics and whether you are a B2B or B2C organization, with B2B response rates typically being slightly higher.

For Net Promoter Score (NPS) surveys specifically, a survey response rate that is greater than 20% is considered good in the customer support and experience industries.

There is some debate about the ‘bigger is better’ response rate mentality, and how much it actually helps survey quality, but if you aim for these average response rates, you should be able to ascertain some insight into your audience. Unsurprisingly, quality answers are more important than quantity.

Why do questionnaires have a low response rate?

There are lots of contributing factors to questionnaires having a low response rate. For example, surveys with too many questions or poorly constructed answer options can cause people to drop off. From bad timing and poorly written invitations to bad subject lines and survey fatigue, there are lots of places where a survey can go wrong.

The lowest survey responses tend to come from unknown senders, so it could come down to a lack of familiarity or engagement with your target audience.

What does a low response rate mean?

Low response rates typically indicate one of two things. There’s either something wrong with your survey, or your target audience is not engaged enough to either recognize your name in their inbox or they don’t want to spend the time giving you information.

If you’re asking for customer feedback in particular, it could be a sign of customer engagement that needs some extra nurturing.

On a more clear level, having a low response rate to your survey also means that you don’t have a sufficient amount of data. Low response rates can give rise to non-response bias, wherein subjects who don’t participate in a survey may turn out to be systematically different from those who do participate. And without their information, you’re potentially missing a very large and very important part of the story.

What is a good sample size for a survey?

This is, in essence, ‘how many survey respondents do you need?’ but the more technical framing is, ‘how big does my sample need to be in order to accurately estimate my population?’

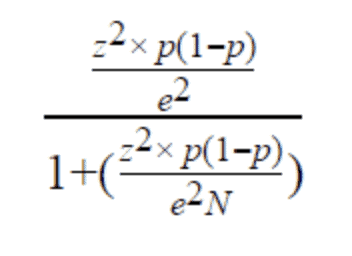

Here is the formula that statisticians use to calculate the ideal sample size for survey distribution:

N = population size

e = margin of error (as a decimal)

z = confidence level (as a z-score statistic)

p = percentage value (as a decimal)

For those of us who are not data scientists or statistics professionals, there is an easier way to determine the perfect number of people to send your survey to, and it doesn’t involve quite as intense math skills.

The first step is to identify how big your population is. Who do you want to understand? Are you gathering feedback from users of your app? Are you soliciting customer feedback? Perhaps you’re undertaking market research for a new market you’re considering launching in? How big is that group of people?

Take that number and account for your margin for error, then consider how certain you need to be that your sample accurately samples your population – this is your confidence level. 95% is most common (90-99% is a good range) but don’t go below 90%.

Finally you must consider response rates. 10-15% is a good conservative estimate, but if you have an engaged audience and a track record of survey success, 20-30% might be more accurate.

Essentially you take your population, account for your margin for error, confidence level, and anticipated response rates, and that tells you how many surveys to send.

For example, if you need 100 responses, and you expect a 10% response rate from that demographic, then you need to send it to 1000 people in your population. If you’ve never surveyed these people before, 10-15% is a much safer response rate expectation.

Respondents needed ÷ Response rate = Number of surveys to send out

What is a good margin of error?

A margin of error is a statistic that tells you the amount of random sampling errors in the results of a survey. The bigger the margin, the less confidence you should have that the survey results actually reflect your target group’s views and sentiments.

5% is the most common margin of error, but anywhere between 1-10% is standard.

How do you deal with a low response rate in a survey?

If you’ve sent out your survey and the response has been underwhelming, you can try any number of tips and tricks to try to deal with the issue. Take another look at your survey and make sure that it is simple, straight-forward, and gives your respondents the opportunity to speak their mind.

Once you’ve established that your survey is up to snuff, you can send a few polite, friendly, and personalized follow up reminders and friendly nudges. If you didn’t offer any incentives the first time around, now might be the time to have a look at your budget and see what you can offer people for taking time out of their busy days to help you out.

Start surveying your customers today

World class experiences start with meaningful insights. When you’re preparing to kick off your next customer survey, make sure you have the means to analyze and action your customer’s feedback and address their pain points, including all of the insightful responses to the open ended question you were potentially reluctant to include.

Idiomatic categorizes and quantifies open-ended feedback from customer surveys to help you identify trends and insights.

Request a demo with Idiomatic today to gather actionable insights from your survey responses in any format.