Do you know how effective and profitable your sales and marketing efforts are? You may be spending more to acquire a new customer than they’re worth. Your Customer Acquisition Cost (CAC) helps you measure your company’s profitability efforts in acquiring new customers. A general rule of thumb is that if you spend more to close a customer than they’re worth to your business, you should consider a change of strategy or tactics.

In the article we’re going to help you understand how to calculate customer acquisition cost and how to optimize it. We’ll answer:

- What is the CAC Formula?

- Why is customer acquisition cost important for businesses?

- How is CAC LTV calculated?

- What is a customer acquisition cost example?

- What is a good benchmark CAC?

- How do you optimize customer acquisition cost?

- How can you use machine learning with Customer Acquisition costs

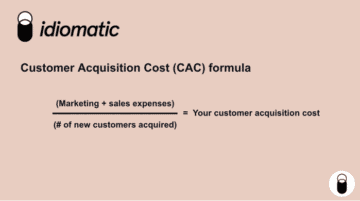

What is the CAC formula?

The customer acquisition cost (CAC) formula measures how much you spend to get a new customer. To calculate the monetary cost to acquire your average customer, you first need to know how much you’re spending on sales and marketing. Then, you need to know how many new customers you acquire.

The end result will tell you exactly how much you spent to close your average customer during a specified period.

How to calculate customer acquisition cost

To calculate your basic customer acquisition cost:

Your marketing and sales expenses will be different depending on your budget and spend line items but may include:

- Employee salaries or bonuses

- Ad spend

- Creative costs (copywriting, graphics, production)

- Tool costs (like reporting tools, analytics software, and an AI-driven platform for data analysis and prediction)

- Publishing or production costs

- Inventory upkeep

This customer acquisition cost formula can give you a good indication of your costs to acquire new customers. Depending on the data sets you use, you can get a detailed perspective or a high-level view. Here are four basic “views” you can use the CAC formula to calculate:

Source/medium level

This is the most detailed view you can get. This level of CAC specificity helps you determine the effectiveness of your strategy or creative for a specific marketing source, channel, or medium. To calculate your CAC at this level, take your marketing spend for the particular source or medium, and divide it by the number of new customers that channel earned your business.

Example: Your business spent $500 on Google Ads last month. From these ads, 50 new sign-ups came from people who clicked on your ads. That month, you spent $10 per customer acquired for this channel.

Campaign level

To determine if a campaign is effective, you can combine all marketing and sales expenses for that campaign to calculate your customer acquisition cost.

Example: Your business spent $500 on Google Ads and $250 on pay-per-click ads for a specific campaign over 1 month. With a total cost of $750 to acquire 50 new customers, your customer acquisition cost per new sign-up is $15.

Time Period

To get a business-level overview of how much you’re spending across all channels and campaigns for a given period, add up all marketing and sales expenses and divide it by new customers who came in during the same time.

Example: Over three months, your team spent $1,000 in advertising marketing costs, $500 on ad copywriting and graphic design, and your sales team submitted expenses for $1,000 directly related to nurturing and closing new clients. With a total cost of $2,500 to close 150 customers, your customer acquisition cost (CAC) was $16.66 for that period.

Demographic level

From a business perspective, it may be helpful to understand the acquisition costs for each company product or service, independently, especially if they are for different target customers or price points.

For example, it may be easier to sell lower-priced products than higher-priced ones. Knowing which products sell more units can help you determine an acceptable cost per acquisition for that offering.

You may also want to compare different customer groups.

For example, if you sell a bikini-of-the-month subscription box, you may want to see how much it costs to sell to a customer in Florida vs Michigan in December. To do this, calculate your marketing costs targeted to each region separately and divide this total by the number of new customers from those regions.

Why is customer acquisition cost important for businesses?

Calculating your customer acquisition cost helps you determine the effectiveness of your sales and marketing efforts. The benefits of knowing this amount include:

- Optimizing marketing creative: You’ll have the data to see which marketing creative and strategies are most effective for closing new clients. You can then change your campaigns or strategy to optimize your CAC to pay less per new client or earn more revenue per client.

- Optimizing profit margins: If you’re spending too much money to acquire a customer, you may want to adjust your offer pricing to increase your profit margins. Or you can add more value to your offering to attract new customers.

- Better understanding your LTV: Your customer lifetime value (LTV) measures how much you earn from a customer over their lifetime. Knowing how much you can expect from a customer helps you determine an acceptable amount to spend to earn their business in the first place.

How is CAC and LTV calculated?

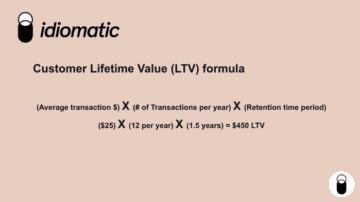

Lifetime value (LTV) is the projected revenue you’ll earn from a typical account over their lifetime as your customer. To know how much you can expect from a customer, you need to know:

- Average transaction cost

- # of transactions over a year

- Your customer retention timeframe

For example, if you’re a SaaS company and you sell a $25 monthly subscription, and you know people stay subscribed for an average of 18 months, you can calculate your LTV using this formula:

This means you can expect to earn $450 from the average customer. This is important to help you calculate acceptable or target CACs that don’t go above this amount, and which leave you with a healthy profit margin.

Read More: Predict customer lifetime value with machine learning

CAC vs LTV

Knowing you’re likely to earn $450 per customer helps determine how much you’re willing to spend on marketing and sales expenses to get new customers.

If your CAC calculation determined you spend an average of $10 to acquire a customer, that’s a decent profit for a customer who will spend $450. However, if you’re paying $500 to acquire the same type of customer, that’s not profitable because you don’t expect to earn that much from the customer over their lifetime with your business.

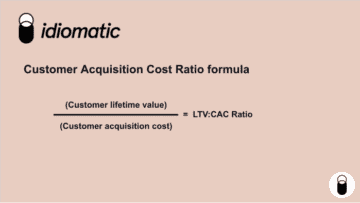

What is the customer acquisition cost ratio?

Once you know how much you’re spending on customer acquisition and how much money you earn from the average customer, this gives you your customer acquisition cost ratio:

For example, if you expect to earn $500 per customer, and you calculate spending $250 per customer acquisition, the calculation is as follows:

$500 / $250 = 2 (or 2:1)

This means you can expect to earn 2x as much revenue from a customer as you spend to acquire them.

What is a customer acquisition cost example?

SaaS businesses use machine learning and predictive analytics to better understand their customers, inform business decisions, and make acquiring customers more profitable by increasing customer satisfaction and LTV. Here are two examples of businesses making changes to optimize or justify their CAC:

Pinterest increasing average revenue per customer

Pinterest wanted to better understand its customers’ pain points and opportunities to increase average revenue per advertiser. They used Idiomatic to analyze data from eight different data sources, create a custom, granular categorization of customer feedback across these data sources, and train the machine learning algorithm to accurately predict categorizations with accuracy in real-time.

This data gave them a deeper understanding of the voice of their customer, which they could use to nurture current and potential customers. They used this data to effectively reduce platform complaints by 58% and increase positive customer feedback by 62%.

What is a good benchmark CAC?

Most successful companies budget 7-8% of their revenues for marketing investments. To best optimize their marketing spend, marketing staff will continually review their strategies and channels to ensure they’re bringing in the lowest cost per acquisition possible.

It helps to have a customer acquisition cost goal or target cost. Over time, your business will better understand its own benchmarks, but those just getting started can use industry averages to create their targets. Some examples of industry CAC benchmarks include:

- Travel industry: $7

- Retail: $10

- Manufacturing: $83

- Digital Marketing Agency: $141

- Technology (Hardware): $182

- Banking: $303

- Technology (Software): $395

How do you optimize customer acquisition cost?

The best way to optimize customer acquisition costs is to improve your customer retention rate. It costs much less to keep a customer than to acquire a new one. Having said that, here are a few strategies to help keep customer acquisition costs low:

- Know your customer: Dig deeper to understand your customers better. Then tailor your acquisition strategies to speak to their pain points, needs, and expectations. This can help you attract more customers for a lower cost.

- Focus on customer relationship management: Your company can more likely afford a higher CAC if you know your LTV is higher. Look for ways to improve customer relationships and satisfaction to increase customer spending and lifetime with your brand to help justify higher CAC costs.

- Begin engagement early: Consider other avenues to build brand awareness and trust before your campaign-level effort. This might include publishing educational blog content, being active on social media, and doing other brand outreach activities to attract new paying customers. This earns trust early, so they’re more likely to follow through and convert when they see your branded ad online.

- Review campaigns and channels often: Not every business has success advertising on Google or Facebook. You may get a higher ROI (and lower CAC) when you purchase ad space on an industry vertical website. Experiment with different channels and marketing content often to ensure you optimize spending on channels that give you a higher ROI.

- Automate the process: Link your customer acquisition data to your CRM to automate marketing to potential customers. You can also go a step further to link your customer data to an AI driven platform to further understand your customers’ experiences and lifetime value of each acquisition channel, and make adjustments accordingly.

How can you use machine learning with Customer Acquisition costs

You can include your customer acquisition and lifetime value data in your analytics to help predict the future of your business. Using machine learning algorithms with this data, you can help predict customer churn rates and see what area of your business needs re-strategizing to increase customer retention and happiness.

Idiomatic can help you predict analytics like customer lifetime value, customer acquisition costs, and customer churn to plan better sales and marketing campaigns to acquire more customers for lower cost per closed lead.

Request a demo to see how you can use Idiomatic as part of your customer acquisition strategy.